Summer has become an increasingly important season for the ski resort industry, and optimizing year-round recreation provides advantages to ski operators ready to expand their business beyond winter.

Summer Business Trending Upward

In their summer 2014 issue, the National Ski Areas Association (NSAA) Journal published research by leading industry analysts RRC Associates that examined summer operations at ski resorts. Using data from three separate surveys, the authors determined that the summer season, though still a burgeoning source of revenue for ski operators, holds much promise for the future of the industry.

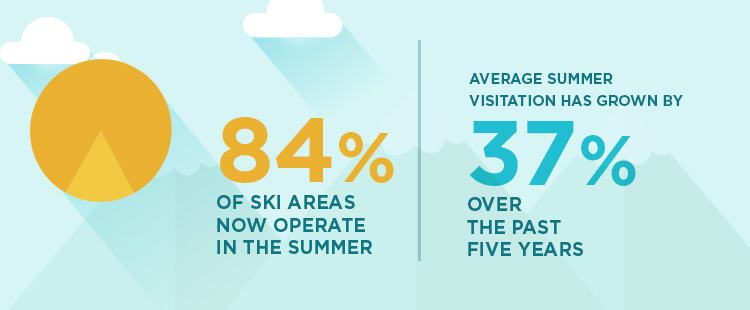

According to Michael Berry, President of the NSAA, the ski industry “views the growth of summer revenues as a critical component of their future.” This is reflected in the fact that 84% of ski areas currently operate in the summer.

David Belin of RRC Associates challenges the notion of summer as a desert of downtime. He claims that while indeed shorter than the winter season, the summer actually draws more steady patronage, with visitation consistent because it is based on the lengthy break provided by the school schedule. He highlights the importance of families: “Attracting families is a huge opportunity and, unlike during the winter, we don’t just get to do it during school breaks and holidays—we have a whole three months.”

In the NSAA National Survey of Summer Destination Travelers, 13% of the respondents cited visiting a mountain area as the impetus for their summer trip. Of this subset, travelers took 2.4 as many types of summer trips over a three year period as compared to non-mountain travelers. Capturing the attention of this style of traveler could be as beneficial as appealing to the die-hard downhill crowd.

Recent data showed that Western resort lodging set records for the 2014 summer months, with summer lodging revenue up 14% overall versus the summer prior. More broadly, average summer visitation has grown 37% over the past five summers, as resorts begin to cater to the leisure customer as well as tried-and-true slope enthusiasts.

Legislation Changes Led to Growth

While the conversation about seasonality certainly isn’t new for the ski industry, some contributing factors are more recent.

One significant shift is that until recently, resorts operating on land owned by the United States Forest Service (USFS), which authorizes permits to 122 ski areas, were under special restrictions which kept summer activity limited.

It wasn’t until the Ski Area Recreational Opportunity Enhancement Act was passed in 2011 that legislation not only lifted these restrictions, but also encouraged four-season development on USFS-owned land. Viewed as a way to draw revenue and economic growth to ski areas and resort communities during slower months, the result was that all ski areas, whether USFS-owned or not, were suddenly in competition to develop summer amenities.

Utilizing Infrastructure

As growth opportunities unfold, the target customer for ski resorts has expanded to include non-skiers. Those who choose the mountains as their primary destination have cited scenic beauty of the area, rest and relaxation, enjoyment of a ski resort and the surrounding town, and climate as the reason for their trips—all things that don’t necessarily require ski skills to be enjoyed.

For the operator, summer activity on ski resorts doesn’t necessarily require costly renovations to be successful, though activities dependent on property development such as waterparks and alpine coasters have been shown to generate more revenue. The NSAA reported in their 2015 end of season survey that among resorts offering activities in summer, waterpark usage is particularly high, with an average amount of visits over twice that of other summer amenities. However, many operators leverage existing infrastructure and still get desired results.

Summer events and festivals are one of the most popular ways to use current resort infrastructure to drive revenue. By attracting large groups to their site, resort operators make money on lodging and on-site spending such as food and beverage sales and parking revenue.

Summer weddings attract customers as well, and with destination weddings on a steady rise, resort renovations become opportunities for current and future customers. For example, the newly completed Camelback Lodge & Indoor Waterpark in the Poconos designed facilities specifically for bridal ceremony and reception use. Considering the wedding industry generated $55B in 2014, catering to the nuptial crowd can be smart business.

While the relative newness of this category in the summer makes long-term data scant, expanding approaches to seasonality are clearly underway and creating opportunities for operators and visitors alike. Marketing efforts to raise consumer awareness will improve as data improves, and may be the next step in what looks like inevitable growth for the ski industry.

Sources

Associated Press. (April 7, 2015). Ski resorts turn themselves into summer resorts too. The New York Times. Retrieved from http://www.nytimes.com/aponline/2015/04/07/us/ap-us-travel-off-season-ski-resorts.html?_r=0

Belin, Dave. (Winter 2015). Economic Analysis Results: A Quick Overview of the 2013-14 Season. NSAA Journal. Retrieved from http://www.rrcassociates.com/wp-content/uploads/2015/02/Economic-Analysis-1314-preview-Winter-1415.compressed.pdf

Belin, Dave and Sarah Esralew (Summer 2014). Summer Business: What’s the Return? NSAA Journal. Retrieved from http://www.rrcassociates.com/wp-content/uploads/2015/03/Summer-Operations-2014-Summer-2014.compressed.pdf

RRC Associates. Kottke National End of Season Survey 2014/15. National Ski Areas Association. Print.

United States Department of Agriculture. (April 15, 2014). U.S. Forest Service finalizes policy to promote year-round recreation on ski areas. Retrieved from http://www.usda.gov/wps/portal/usda/usdahome?contentid=2014/04/0062.xml